In this study, we researched all Fortune 1000 companies in food, beverages, retail and leisure to determine 50 of the strongest brands in AI models. Using SEO Vendor’s RankLens, we measured how large language models (LLMs) surface these brands when answering real-world food, retail and travel queries.

For our case study: Best AI Brand Visibility = a brand ranks among the strongest performers for at least one of the entities it is most known for (its Top Entity, shown in the Strongest Entity column of the datasheet) in ChatGPT.

Each brand in this Top 50 list is, in effect, an AI category leader for one or more of its defining entities (e.g., “multi-cuisine food offerings,” “vacation ownership opportunities,” “global food and beverage industry”).

RankLens AI Visibility Metrics

RankLens computes six core metrics for each brand.

| Metric | Definition |

|---|---|

| LLM Confidence | Normalized confidence score (0–100) that the LLM reports when its answers include the brand. |

| Brand Appearance | How many times the brand or website appears in sampled responses (out of 4 iterations). |

| Brand Discovery | Probability (percentage) that the brand appears in an LLM response for the tested entities. |

| Brand Target | Normalized measure of how tightly focused the LLM’s responses are on that brand (higher = more “default” choice). |

| Brand Match | Accuracy of matching responses to the intended brand name or website. |

| Visibility Index | Composite 0–100 index combining probability, appearance, discovery, confidence and targeting to summarize overall AI brand visibility. |

Across all 50 Fortune 1000 brands, the score distribution is:

Table 1 – Overall AI Visibility Metrics (Top 50 Fortune 1000 Food & Leisure Brands)

| Statistic | LLM Confidence | Brand Discovery | Brand Target | Brand Match | Visibility Index |

|---|---|---|---|---|---|

| Mean | 90.0 | 97.5 | 91.3 | 89.9 | 92.0 |

| Min | 30.0 | 75.0 | 13.0 | 38.0 | 62.0 |

| Max | 100.0 | 100.0 | 100.0 | 100.0 | 99.0 |

This is a very AI-visible cohort: the typical Fortune 1000 food or leisure brand in this list scores above 90 on the Visibility Index.

Industry Composition of the Top 50

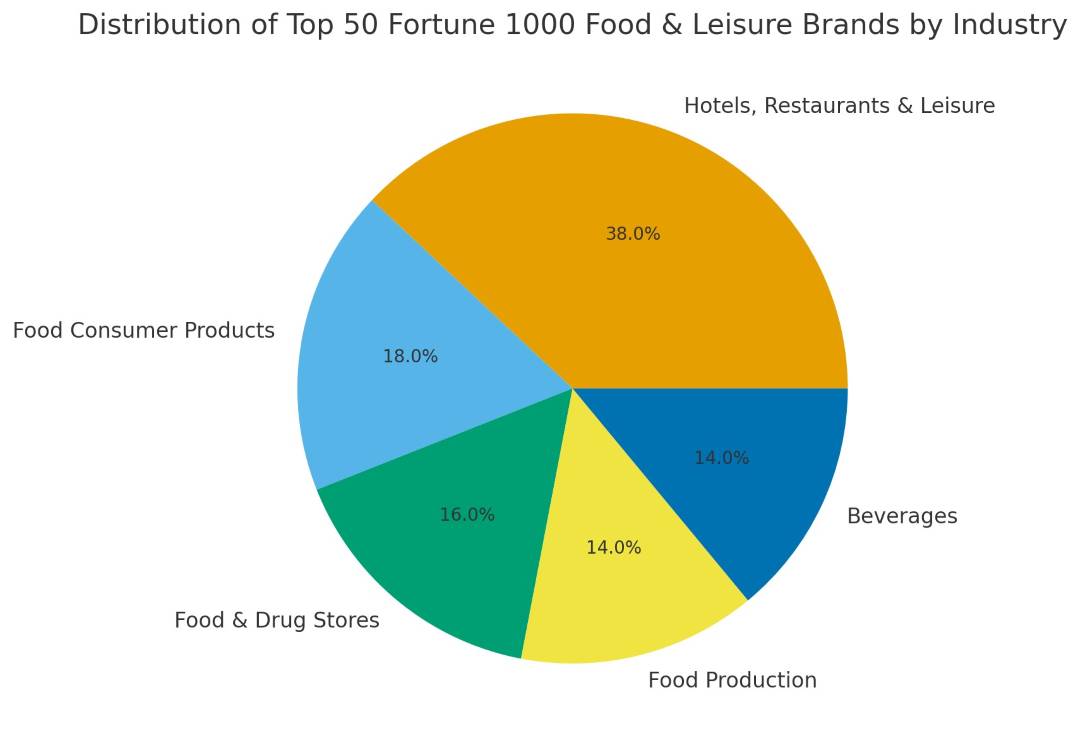

The 50 Fortune 1000 brands span five industries.

Table 2 – Brands by Industry

| Industry | Number of Brands | Share of Top 50 |

|---|---|---|

| Hotels, Restaurants & Leisure | 19 | 38% |

| Food Consumer Products | 9 | 18% |

| Food & Drug Stores | 8 | 16% |

| Food Production | 7 | 14% |

| Beverages | 7 | 14% |

| Total | 50 | 100% |

The pie chart above visualizes this mix: nearly two in five brands are in Hotels, Restaurants & Leisure, confirming that experience-led brands dominate AI conversations around food and travel.

Industry-Level AI Visibility

RankLens shows clear differences by industry in how strongly LLMs surface these Fortune 1000 brands.

Table 3 – Average AI Metrics by Industry

| Industry | Avg Visibility Index | Avg LLM Confidence | Avg Brand Discovery | Avg Brand Target | Avg Brand Match |

|---|---|---|---|---|---|

| Hotels, Restaurants & Leisure | 94.8 | 93.2 | 98.7 | 95.4 | 86.3 |

| Food & Drug Stores | 93.0 | 81.2 | 100.0 | 100.0 | 94.5 |

| Food Consumer Products | 92.1 | 91.7 | 97.2 | 90.3 | 93.3 |

| Beverages | 88.3 | 83.3 | 96.4 | 87.6 | 84.1 |

| Food Production | 87.0 | 95.6 | 92.9 | 75.1 | 95.9 |

The bar chart titled “Average AI Brand Visibility by Industry” shows:

- Hotels, Restaurants & Leisure at the top, with the highest average Visibility Index and strong Discovery and Target scores.

- Food & Drug Stores achieving perfect Brand Discovery and Brand Target on average—LLMs frequently surface these brands and treat them as default choices in their local shopping and grocery narratives.

- Food Production and Beverages lag slightly in overall AI visibility, despite strong confidence and match. LLMs know these brands, but are more selective about pushing them into broad consumer-facing recommendations.

AI Visibility Tiers: Dominant, Competitive, Emerging

To make the data actionable, RankLens segments brands into AI Visibility Tiers:

- Dominant: Visibility Index ≥ 98

- Competitive: 90–97

- Emerging: < 90

Table 4 – Fortune 1000 Brands by AI Visibility Tier

| Tier | Visibility Index Range | Number of Brands |

|---|---|---|

| Dominant | ≥ 98 | 20 |

| Competitive | 90–97 | 19 |

| Emerging | < 90 | 11 |

| Total | 50 |

The “Number of Brands by AI Visibility Tier” bar chart visually reinforces that four in five brands are already Competitive or better, but there is still a meaningful tail of Emerging brands that AI does not yet elevate as consistently.

Tier Profiles

Table 5 – Average Metrics by AI Visibility Tier

| Tier | # Brands | Avg Visibility Index | Avg Brand Discovery | Avg Brand Target | Avg LLM Confidence | Avg Brand Match |

|---|---|---|---|---|---|---|

| Dominant | 20 | 98.6 | 100.0 | 100.0 | 98.4 | 94.6 |

| Competitive | 19 | 95.5 | 100.0 | 100.0 | 89.3 | 82.8 |

| Emerging | 11 | 74.2 | 88.6 | 60.5 | 75.7 | 93.6 |

Key observations:

- Brand Discovery and Brand Target are the defining levers. Both are perfect (100) for Dominant and Competitive tiers, but fall sharply for Emerging brands.

- LLM Confidence rises as we move from Emerging to Dominant, but its correlation with Visibility Index is modest compared to Discovery and Target.

- Brand Match remains high even for Emerging brands, showing that accuracy alone does not guarantee prominence in AI answers.

The Leaders: Top 10 Fortune 1000 Brands by AI Visibility

Among the Fortune 1000 Food & Leisure cohort, the following brands achieve the highest Visibility Index scores (all at 99):

Table 6 – Top 10 Fortune 1000 Food & Leisure Brands by AI Brand Visibility

| # | Company | Industry | Visibility Index | Brand Discovery | Brand Target | LLM Confidence | Brand Match |

|---|---|---|---|---|---|---|---|

| 1 | Cheesecake Factory | Hotels, Restaurants & Leisure | 99 | 100 | 100 | 100 | 100 |

| 2 | MGM Resorts International | Hotels, Restaurants & Leisure | 99 | 100 | 100 | 100 | 100 |

| 3 | TreeHouse Foods | Food Consumer Products | 99 | 100 | 100 | 100 | 100 |

| 4 | Topgolf Callaway Brands | Hotels, Restaurants & Leisure | 99 | 100 | 100 | 100 | 51 |

| 5 | PepsiCo | Food Consumer Products | 99 | 100 | 100 | 100 | 100 |

| 6 | Peloton Interactive | Hotels, Restaurants & Leisure | 99 | 100 | 100 | 100 | 100 |

| 7 | Conagra Brands | Food Consumer Products | 99 | 100 | 100 | 100 | 100 |

| 8 | Marriott Vacations Worldwide | Hotels, Restaurants & Leisure | 99 | 100 | 100 | 100 | 76 |

| 9 | Ingredion | Food Production | 99 | 100 | 100 | 100 | 100 |

| 10 | Domino’s Pizza | Hotels, Restaurants & Leisure | 99 | 100 | 100 | 100 | 100 |

The table highlights how tightly clustered these leaders are at the top of the index.

What sets them apart?

- Perfect Discovery and Target – Each appears in 100% of relevant AI responses and is treated as a primary answer rather than one of many equal alternatives.

- Excellent Match – Apart from one partially ambiguous brand (Topgolf Callaway Brands), Brand Match scores are extremely high.

- Clear Top Entities – Each brand owns a distinct Top Entity in the LLM’s representation, such as:

- “multi-cuisine food offerings” (Cheesecake Factory)

- “integrated resort destinations” (MGM Resorts International)

- “global food and beverage industry” (PepsiCo)

- “customizable pizza menu selections” (Domino’s Pizza)

These Top Entities are where Best AI Brand Visibility truly manifests: when users ask about these specific concepts, the LLM consistently gravitates toward these brands.

Top Entities: How AI Knows These Brands

Each Fortune 1000 brand in the dataset is associated with a Strongest Entity—the concept for which it exhibits the best AI Brand Visibility. A few patterns emerge:

Table 7 – Examples of Top Entities Driving “Best AI Brand Visibility”

| Brand | Top Entity (Strongest Entity) | Interpretation in AI Answers |

|---|---|---|

| Cheesecake Factory | multi-cuisine food offerings | AI surfaces it for diverse sit-down dining with broad menus. |

| MGM Resorts International | integrated resort destinations worldwide | AI favors it for destination resort and casino queries. |

| Domino’s Pizza | customizable pizza menu selections | Appears as a default for fast, customizable pizza delivery. |

| Marriott Vacations Worldwide | vacation ownership opportunities | Dominant in timeshare and vacation ownership narratives. |

| PepsiCo | global food and beverage industry | Frequently referenced for large-scale consumer packaged foods and beverages. |

| Ingredion | sustainable plant-based ingredients | Key player in AI answers around sustainable food ingredients. |

Because each brand ranks best for its own Top Entity, this Top 50 list reflects where AI already sees these Fortune 1000 brands as category leaders.

Strategic Takeaways for Fortune 1000 Brand Leaders

From a CMO or SEO strategy perspective, this Fortune 1000 dataset suggests several priorities:

1. Design for Discovery, Not Just Brand Recall

The strongest driver of Best AI Brand Visibility is Brand Discovery—the probability that your brand shows up at all for a given intent. Content and digital assets should be optimized to:

- Tie your brand directly to intent-rich, non-branded queries.

- Reinforce the Top Entity you want to own (e.g., “family resort in Las Vegas,” “plant-based ingredients for food manufacturers”).

2. Tighten Your Target: Become the Default Answer

Brands in the Dominant tier combine high Discovery with perfect Brand Target scores. That means the LLM doesn’t just know them; it relies on them as the obvious choice.

Tactically, this means:

- Clarifying positioning so that your brand is the least controversial recommendation for a specific use case.

- Building consistent language and structured data around that use case across first- and third-party properties.

3. Accuracy Is Necessary but Not Sufficient

Emerging brands often have high Brand Match, meaning the LLM represents them correctly when asked. But with weaker Discovery and Target, they rarely become the top suggestion in ambiguous or open-ended queries.

The implication: being correctly defined in AI is table stakes; winning requires being frequently and confidently recommended.

4. Track AI Visibility as a Core KPI

For Fortune 1000 Food & Leisure brands, traditional KPIs like market share, organic traffic and brand lift now need a companion metric:

- AI Brand Visibility, captured through RankLens’ Visibility Index, Discovery, Target and Match metrics.

Over time, brands that monitor and optimize these AI-native KPIs will gain compounding distribution advantages as consumers increasingly rely on AI assistants to decide where to eat, what to drink, what to cook and where to stay.

Conclusion

This exclusive analysis of Top 50 Fortune 1000 Food & Leisure Brands by Best AI Brand Visibility shows that:

- AI models already have clear favorites, particularly in hospitality and experiential categories.

- Best AI Brand Visibility occurs where a brand is the top performer for a specific Top Entity—the concept it is most known for in the model’s knowledge graph.

- Discovery and Targeting matter more than raw confidence or name recognition: it is not enough to be well-known; a brand must be the most natural answer to a user’s question.

For SEO Vendor clients and partners, the RankLens framework offers a new, quantifiable lens on AI-era brand equity—one that extends far beyond the search results page into the emerging world of conversational discovery.

Download the Entire PDF Datasheet (Breakout individual reports):

Top 50 Fortune 1000 Food & Leisure Brands by Best AI Brand Visibility (Data Sheet).